In the dynamic world of international trade, efficient and secure payment systems are the bedrock of successful transactions. For Syrian traders, navigating this landscape presents unique challenges and opportunities. This article, developed in collaboration with AlTojjar, aims to demystify international payment methods, shed light on the crucial role of correspondent banking, and address the complexities of compliance and sanctions. Our goal is to empower Syrian businesses with the knowledge and tools to facilitate legitimate financial flows, fostering growth and expanding their reach in global markets. AlTojjar stands as a vital bridge, connecting Syrian enterprises with reliable financial institutions and offering expert guidance to overcome transactional hurdles.

Payment Methods: Wire Transfers, SWIFT, and Other International Payment Options

International trade relies on a variety of payment methods, each offering different levels of risk and control for both importers and exporters. Understanding these options is crucial for Syrian traders seeking to engage with global partners.

Wire Transfers

Wire transfers, also known as telegraphic transfers (T/T), are one of the most common and fastest methods for international payments. Funds are electronically transferred directly from one bank account to another. While offering speed and reliability, wire transfers typically require payment in advance, placing the risk on the importer. For Syrian traders, this method can be efficient for trusted partners or smaller transactions, but it necessitates careful due diligence on the part of the importer to ensure goods are shipped as agreed.

SWIFT (Society for Worldwide Interbank Financial Telecommunication)

SWIFT is not a payment system itself, but rather a global messaging network that facilitates secure and standardized communication between financial institutions worldwide. When a wire transfer is initiated, banks use SWIFT messages to transmit payment instructions, ensuring accuracy and security. The SWIFT network is integral to most international financial transactions, including those involving trade finance instruments. Its widespread adoption makes it a critical component for Syrian traders engaging in cross-border payments, as it provides a reliable backbone for interbank communication.

Other International Payment Options

Beyond wire transfers, several other methods offer varying degrees of security and flexibility, often involving banks as intermediaries:

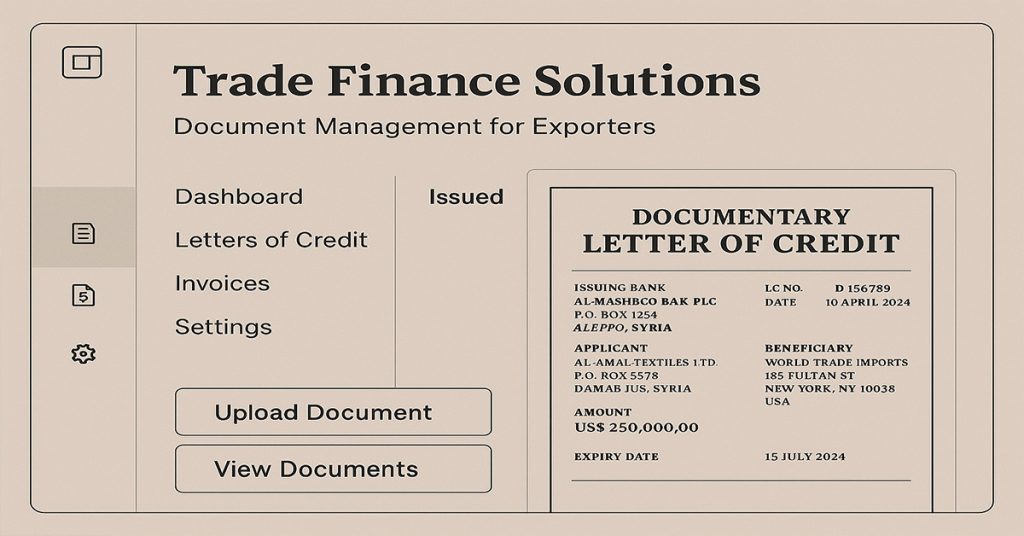

- Letters of Credit (LCs): A letter of credit is a commitment by a bank on behalf of the buyer (importer) to pay the seller (exporter) a specified sum of money, provided the seller presents stipulated documents within a prescribed time. LCs significantly reduce risk for the exporter, as the bank guarantees payment. For Syrian traders, LCs can be particularly valuable when dealing with new or less-known international partners, as they provide a secure payment mechanism.

- Documentary Collections: In a documentary collection, banks act as facilitators for the exchange of documents against payment or acceptance of a bill of exchange. Unlike LCs, banks do not guarantee payment but merely handle the documents. This method offers a balance between risk and cost, making it suitable for established trading relationships where a degree of trust already exists.

- Open Account: This is the least secure method for the exporter, where goods are shipped and delivered before payment is due, typically in 30, 60, or 90 days. This method is common in highly trusted, long-standing relationships or within multinational corporations. While offering maximum flexibility to the importer, it carries significant risk for the exporter, especially in uncertain geopolitical climates.

Each payment method has its advantages and disadvantages, and the choice often depends on the level of trust between trading partners, the value of the transaction, and the prevailing economic and political conditions. Syrian traders should carefully assess these factors to select the most appropriate payment mechanism for their international dealings.

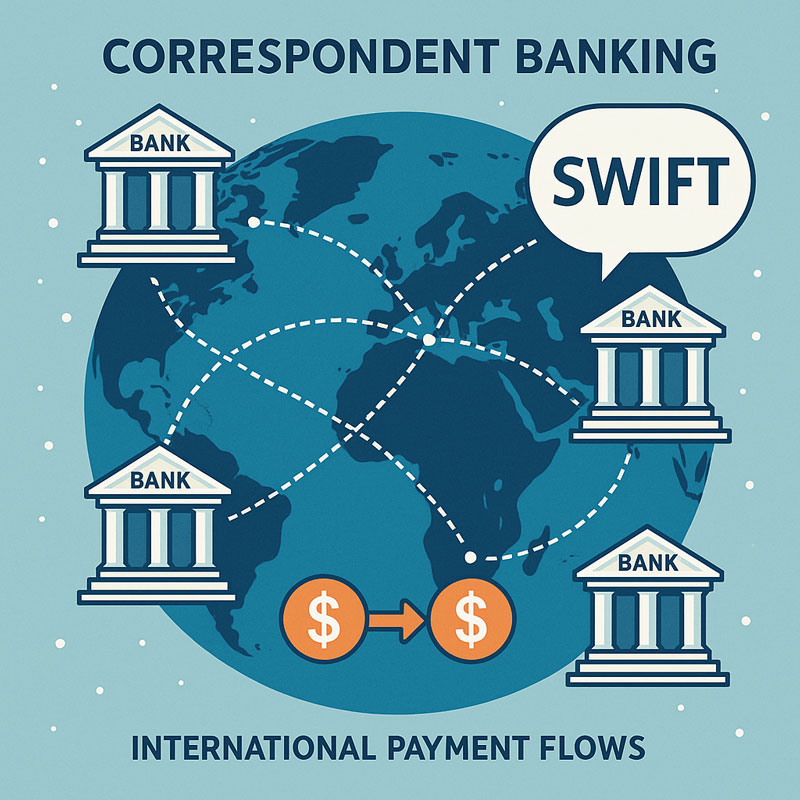

Correspondent Banking: Understanding its Role in Cross-Border Transactions

Correspondent banking is the backbone of international finance, enabling cross-border transactions and facilitating global trade. It involves a relationship where one bank (the correspondent bank) provides services to another bank (the respondent bank), typically in a different country.

Definition and Function

At its core, correspondent banking allows banks to access financial services in jurisdictions where they do not have a physical presence. For instance, a Syrian bank might have a correspondent relationship with a bank in Germany. This German bank would then facilitate transactions in Euros for the Syrian bank's clients, even though the Syrian bank itself doesn't operate in Germany. These services include:

- Payment Processing: Handling international wire transfers, clearing and settlement of payments in various currencies.

- Trade financing: Facilitating letters of credit, documentary collections, and other trade finance instruments.

- Foreign Exchange: Providing access to foreign exchange markets.

- Cash Management: Managing foreign currency accounts for respondent banks.

Importance for International Trade

For Syrian traders, correspondent banking is indispensable. It provides the necessary channels for their local banks to connect with the global financial system. Without these relationships, conducting international business would be significantly more challenging, if not impossible. Correspondent banks essentially act as intermediaries, allowing funds to flow smoothly and securely across borders, supporting import and export activities.

Challenges and De-risking

Despite its critical role, correspondent banking has faced significant challenges, particularly in recent years. Increased regulatory scrutiny, especially concerning Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations, has led some global banks to reduce or terminate correspondent relationships with banks in certain regions, a phenomenon known as 'de-risking.' This can be particularly impactful for countries like Syria, making it harder for legitimate businesses to access international financial services. However, as recent developments indicate, there is a growing recognition of the need to maintain these vital channels for humanitarian and legitimate trade purposes.

Compliance and Regulations: Adhering to International Banking Standards

International banking operates under a complex web of regulations designed to ensure financial stability, combat illicit financial activities, and protect consumers. For Syrian traders and their banking partners, adherence to these standards is paramount.

Key International Regulations

Several international frameworks and regulations govern cross-border financial transactions:

- Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT): These regulations require financial institutions to implement robust controls to prevent their services from being used for money laundering or terrorist financing. This includes customer due diligence (CDD), suspicious activity reporting (SARs), and record-keeping.

- Basel Accords (Basel III): Developed by the Basel Committee on Banking Supervision, these accords provide a global regulatory framework for banks, focusing on capital adequacy, stress testing, and market liquidity risk. While primarily aimed at banks, their impact trickles down to affect the services available to businesses engaged in international trade.

- Sanctions Regimes: Various countries and international bodies impose economic sanctions against specific countries, entities, or individuals. These sanctions often restrict financial transactions, trade, and other economic activities. Compliance with these regimes is mandatory for all financial institutions involved in international payments.

Importance of Compliance for Syrian Traders

For Syrian traders, understanding and adhering to these compliance requirements is not just a legal obligation but a strategic necessity. Non-compliance by any party in a transaction can lead to severe penalties, including fines, reputational damage, and the disruption of vital financial channels. By ensuring their operations and documentation are fully compliant, Syrian businesses can:

- Building Trust: Demonstrate reliability and trustworthiness to international banking partners and trading counterparts.

- Risk Reduction: Minimize the risk of delayed payments, frozen funds, or legal repercussions.

- Facilitate Transactions: Streamline the process of international payments by meeting all necessary regulatory requirements upfront.

AlTojjar plays a crucial role in educating Syrian traders on these complex compliance landscapes, helping them navigate the intricacies of international banking regulations and ensuring their transactions meet global standards.

Overcoming Sanctions: Strategies for Facilitating Legitimate Financial Flows

The issue of international sanctions has significantly impacted Syria's ability to engage in global trade and access financial services. However, recent developments indicate a shift, and strategies exist for facilitating legitimate financial flows.

Recent Developments in Syrian Sanctions

As of mid-2025, there have been significant changes in the sanctions landscape concerning Syria. The U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) issued Syria General License (GL) 25, providing immediate sanctions relief for Syria [1]. Furthermore, on June 30, 2025, President Trump issued Executive Order 14312, terminating the U.S. comprehensive sanctions program against Syria, effective July 1, 2025, while maintaining sanctions on Bashar al-Assad and certain other individuals [2, 3]. Similarly, the European Union (EU) has also suspended the application of certain sanctions restrictions, including those in the banking, energy, and trade sectors [4, 5]. These developments represent a crucial opportunity for Syrian traders to re-engage with the international financial system.

Strategies for Navigating Remaining Sanctions

Despite the easing of some restrictions, certain sanctions may still apply, and vigilance remains essential. Syrian traders can employ several strategies to navigate the evolving sanctions environment:

- Stay Updated: Continuously monitor updates from relevant sanctions authorities (e.g., OFAC, EU, UN) and legal experts. The landscape is dynamic, and staying informed is critical.

- Due Diligence: Conduct thorough due diligence on all trading partners, financial institutions, and intermediaries to ensure they are not subject to any remaining sanctions. This includes checking sanctions lists and understanding the ultimate beneficial ownership of entities.

- Transparent Documentation: Maintain meticulous and transparent documentation for all transactions, clearly outlining the nature of goods, parties involved, and payment methods. This helps demonstrate compliance and legitimacy.

- Legal Counsel: Seek expert legal advice on complex transactions or when there is uncertainty regarding sanctions applicability. This can prevent inadvertent violations.

- Alternative Payment Mechanisms: Explore and utilize payment mechanisms that are compliant with current regulations. While traditional banking channels are opening, understanding and adapting to alternative, compliant methods can provide flexibility.

Importance of Due Diligence

Due diligence is not merely a regulatory requirement; it is a fundamental practice for risk mitigation. For Syrian traders, robust due diligence helps to:

- Protect Reputation: Avoid association with illicit activities or sanctioned entities.

- Ensure Transaction Smoothness: Prevent delays or blockages in payments due to compliance concerns.

- Building Trust: Foster confidence with international partners and financial institutions by demonstrating a commitment to ethical and legal trade practices.

AlTojjar is committed to providing Syrian traders with up-to-date information and guidance on navigating the complex sanctions environment, helping them to identify and pursue legitimate trade opportunities while adhering to international standards.

AlTojjar's Banking Network: Connecting Traders with Reliable Financial Institutions

AlTojjar is more than just a digital platform; it is a vital bridge connecting Syrian importers and exporters with the global financial ecosystem. Recognizing the unique challenges faced by Syrian traders, particularly in accessing reliable banking services, AlTojjar has strategically built a network and developed resources to facilitate legitimate financial flows.

AlTojjar's Role in Facilitating Banking Access

AlTojjar actively works to mitigate the difficulties Syrian businesses encounter in securing banking relationships. This involves:

- Partnerships with Financial Institutions: AlTojjar is establishing and nurturing relationships with international financial institutions that are willing and able to conduct business with Syrian entities, ensuring compliance with all relevant regulations.

- Verified Business Profiles: The platform provides a mechanism for Syrian businesses to create verified profiles, enhancing their credibility and transparency to potential banking partners and international traders. This pre-verification process can significantly streamline the onboarding process with financial institutions.

- Guidance on Documentation: AlTojjar assists traders in preparing the necessary documentation required by banks for international transactions, ensuring accuracy and completeness to avoid delays or rejections.

Guidance on Navigating International Payment Systems

Beyond connecting traders with banks, AlTojjar offers invaluable guidance on navigating the complexities of international payment systems. This includes:

- Educational Resources: Through its "AlTojjar Academy" and knowledge base, the platform provides detailed explanations of various trade finance methods, including letters of credit, bank guarantees, and other mechanisms, helping traders choose the most suitable option for their needs.

- Expert Consultation: AlTojjar offers personalized guidance on specific transactional challenges, helping traders understand the nuances of international banking regulations and best practices.

- Risk Mitigation Strategies: The platform advises on strategies to reduce exchange risks and fraud, crucial elements for secure cross-border transactions.

Support for Overcoming Financial Transaction Challenges

AlTojjar is committed to helping Syrian traders overcome challenges related to financial transactions and sanctions. This support is multi-faceted:

- Up-to-Date Information: Providing timely updates on changes in sanctions, regulations, and international banking practices, ensuring traders are always operating with the most current information.

- Problem-Solving: Acting as a resource for troubleshooting issues that arise during international payments, leveraging its network and expertise to find compliant solutions.

- Advocacy: Working to highlight the importance of maintaining legitimate financial channels for Syrian trade, contributing to a more inclusive global financial system.

By leveraging AlTojjar's banking network and comprehensive guidance, Syrian traders can confidently engage in international commerce, secure in the knowledge that they have a supportive partner in navigating the complexities of global finance.

Conclusion

Navigating the intricate world of international payments is a critical skill for any trader, and for Syrian businesses, it presents a unique set of considerations. By understanding the various payment methods, appreciating the role of correspondent banking, adhering to international compliance standards, and strategically addressing the evolving sanctions landscape, Syrian traders can confidently engage with the global marketplace. The recent easing of sanctions offers a renewed sense of optimism and opportunity, paving the way for increased trade and economic growth.

AlTojjar stands as a dedicated partner in this journey, providing not just a platform but a comprehensive ecosystem of support, guidance, and connections. Our commitment is to empower Syrian businesses to overcome financial hurdles, expand their international reach, and contribute to the revitalization of Syria's trade potential.

Ready to streamline your international payments and unlock new trade opportunities? Contact AlTojjar today for personalized trade finance guidance tailored to your specific needs. Explore our services, including B2B matching and comprehensive trade facilitation, designed to connect you with reliable partners and simplify your global transactions. Visit AlTojjar.com to learn more and start your journey towards seamless international trade.

References

[1] U.S. Department of the Treasury. (2025, June 30). Treasury Issues Immediate Sanctions Relief for Syria. Retrieved from https://home.treasury.gov/news/press-releases/sb0148

[2] Baker McKenzie. (2025, July 4). United States Lifts Comprehensive Syria Sanctions. Retrieved from https://sanctionsnews.bakermckenzie.com/united-states-lifts-comprehensive-syria-sanctions/

[3] Office of Foreign Assets Control. (2025, *June* 30). FAQs. Retrieved from https://ofac.treasury.gov/faqs/added/2025-06-30

[4] Sidley. (2025, July 2). Syria Sanctions Rollback: U.S., UK, and EU Updates in a Global Context. Retrieved from https://www.sidley.com/en/insights/newsupdates/2025/07/syria-sanctions-rollback-us-uk-and-eu-updates-in-a-global-context

[5] Freshfields. (2025, June 18). What does the US, EU, and UK easing of sanctions on Syria mean for companies?. Retrieved from https://blog.freshfields.us/post/102kgix/what-does-the-us-eu-and-uk-easing-of-sanctions-on-syria-mean-for-companies/