A Comprehensive Guide for Syrian Exporters and Importers

Publication Date: June 11, 2025

Category: Financial Guide

AlTojjar Platform: Syria's Leading B2B E-commerce Platform

1. Introduction: Syria's New Trade Landscape

The lifting of international sanctions against Syria in May 2025 has fundamentally transformed the country's trade landscape, opening unprecedented opportunities for Syrian exporters and importers to engage with global markets. After years of economic isolation, Syrian businesses now find themselves at the threshold of a new era, where access to international trade finance mechanisms has become not just possible, but essential for sustainable growth and market expansion.

The sanctions relief, implemented simultaneously by the United States, European Union, and United Kingdom, has restored Syria's access to the global financial system, including the critical SWIFT network that facilitates international banking transactions. This development is particularly significant for Syrian businesses that have long struggled with payment security and financing challenges in their international trade operations. The reconnection to global financial infrastructure means that Syrian companies can now utilize sophisticated trade finance instruments that were previously inaccessible, with letters of credit standing as perhaps the most important of these tools.

Syria's export portfolio, valued at $1.27 billion in 2023, is dominated by agricultural products and processed foods that align perfectly with global demand trends. Pure olive oil leads Syrian exports at $306 million, followed by calcium phosphates at $148 million, spice seeds at $63.9 million, raw cotton at $48.6 million, and tomatoes at $44.1 million. These products, particularly the agricultural and food items, represent significant opportunities for Syrian exporters to leverage letters of credit in securing payment and expanding into new markets, especially in the Gulf countries and European markets where demand for organic and specialty products continues to grow.

The timing of this sanctions relief coincides with a global shift toward more secure and transparent trade finance mechanisms. International buyers, particularly in developed markets, increasingly prefer working with suppliers who can offer secure payment terms through established banking channels. For Syrian exporters, this means that understanding and effectively utilizing letters of credit is no longer optional but essential for competing in international markets and building trust with new trading partners.

Syrian importers, who brought in goods worth $4.19 billion in 2023, also stand to benefit significantly from renewed access to trade finance instruments. The country's import needs, ranging from refined petroleum and wheat flours to machinery and consumer goods, require substantial financing that can now be secured through letters of credit and other banking instruments. This is particularly important for Syrian businesses looking to establish reliable supply chains and negotiate better terms with international suppliers who may have been hesitant to engage with Syrian companies during the sanctions period.

The role of AlTojjar as Syria's leading B2B e-commerce platform becomes crucial in this new environment. As Syrian businesses navigate the complexities of international trade finance, platforms like AlTojjar provide essential guidance, connections, and educational resources that help companies understand and implement appropriate financing strategies. The platform's focus on connecting Syrian exporters and importers with global markets aligns perfectly with the need for comprehensive trade finance education and support.

This comprehensive guide addresses the specific needs of Syrian businesses operating in this transformed landscape. Whether you are an established exporter looking to expand into new markets or an importer seeking to secure reliable financing for essential goods, understanding letters of credit and their various applications will be fundamental to your success. The guide provides practical insights tailored to Syrian trade contexts, real-world examples relevant to the country's key export and import sectors, and actionable advice for implementing LC strategies that support business growth and risk management.

The opportunities ahead are substantial, but they require careful navigation of new regulatory environments, banking relationships, and international compliance requirements. Syrian businesses that master the use of letters of credit and other trade finance instruments will be best positioned to capitalize on the country's reintegration into the global economy and achieve sustainable growth in international markets.

2. Understanding Letters of Credit: Fundamentals for Syrian Businesses

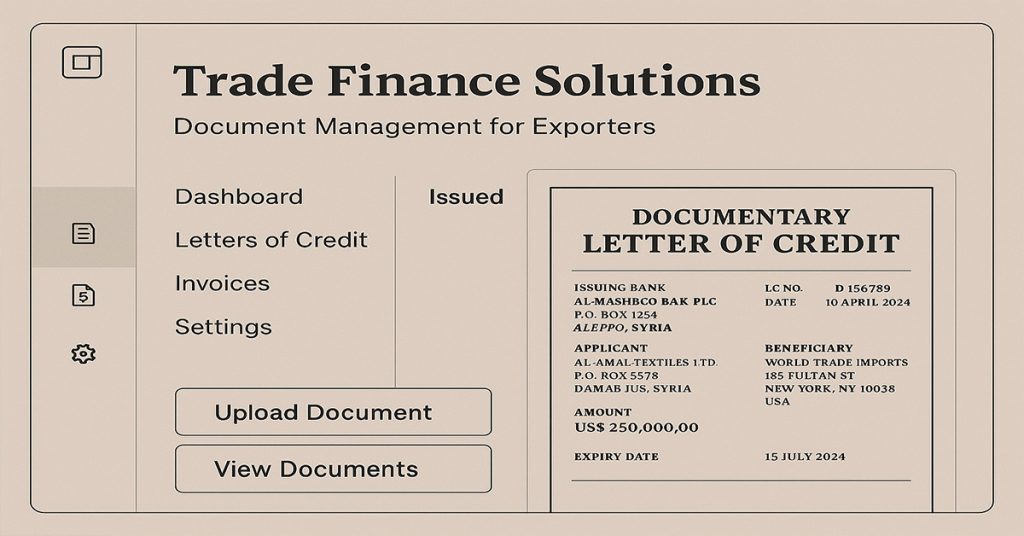

A letter of credit represents one of the most secure and widely accepted payment mechanisms in international trade, serving as a contractual commitment by a buyer's bank to pay the seller once specific conditions are met. For Syrian businesses entering or re-entering international markets, understanding the fundamental principles of letters of credit is essential for building trust with trading partners and securing payment for goods and services.

At its core, a letter of credit functions as a guarantee that removes the payment risk typically associated with international transactions. When a Syrian exporter ships olive oil to a buyer in Germany, for example, the German buyer's bank issues a letter of credit that promises payment to the Syrian exporter upon presentation of specified documents proving that the goods have been shipped according to the agreed terms. This mechanism protects both parties: the Syrian exporter is assured of payment, while the German buyer is assured that payment will only be made when the goods are actually shipped and documented properly.

The fundamental structure of a letter of credit involves four primary parties, each playing a crucial role in the transaction process. The applicant, typically the buyer or importer, requests the letter of credit from their bank and provides the necessary financial backing or credit facilities. The issuing bank, usually the buyer's bank, creates and issues the letter of credit based on the applicant's request and creditworthiness. The beneficiary, typically the seller or exporter, receives the letter of credit and must comply with its terms to receive payment. Finally, the advising bank, often located in the beneficiary's country, receives and forwards the letter of credit to the beneficiary, sometimes adding its own confirmation for additional security.

For Syrian businesses, this four-party structure offers significant advantages in the current trade environment. Syrian exporters can work with local banks such as the Commercial Bank of Syria, which is now authorized to participate in international letter of credit transactions following the sanctions relief. These local banks can serve as advising banks, helping Syrian exporters understand the terms and requirements of letters of credit issued by foreign banks. Additionally, Syrian banks can now issue letters of credit for Syrian importers, enabling them to secure goods from international suppliers with the backing of local financial institutions.

The documentary nature of letters of credit provides another fundamental advantage for Syrian businesses. Unlike other payment methods that rely on trust between trading parties, letters of credit are based on documents rather than the actual performance of the underlying sales contract. This means that a Syrian exporter of spice seeds to India will be paid based on presenting the correct shipping documents, commercial invoices, and certificates of origin, regardless of whether the buyer is completely satisfied with the goods upon arrival. This documentary principle provides crucial protection for Syrian exporters who may be working with new international customers and need assurance of payment.

The independence principle further strengthens the security offered by letters of credit. This principle establishes that the letter of credit transaction is separate and independent from the underlying sales contract between the buyer and seller. If a dispute arises between a Syrian cotton exporter and their Turkish buyer regarding the quality or delivery of the cotton, the letter of credit payment obligation remains intact as long as the exporter presents documents that comply with the letter of credit terms. This independence protects Syrian exporters from potential disputes that might otherwise delay or prevent payment.

Understanding the different types of documentary requirements is crucial for Syrian businesses utilizing letters of credit. Commercial documents typically include commercial invoices, packing lists, and weight certificates that describe the goods being shipped. Transport documents such as bills of lading, airway bills, or truck receipts prove that the goods have been shipped to the buyer. Insurance documents demonstrate that the goods are protected against loss or damage during transit. Official documents might include certificates of origin, quality certificates, or phytosanitary certificates, which are particularly important for Syrian agricultural exports that must meet specific quality and safety standards in destination markets.

The timing aspects of letters of credit also provide significant benefits for Syrian businesses managing cash flow and working capital. Sight letters of credit provide immediate payment upon presentation of compliant documents, which is ideal for Syrian exporters who need quick access to funds for ongoing operations. Usance or time letters of credit allow for deferred payment, typically 30, 60, or 90 days after document presentation, which can help Syrian importers manage their cash flow while still providing security to their suppliers.

The irrevocable nature of most modern letters of credit provides additional security for Syrian businesses. An irrevocable letter of credit cannot be modified or cancelled without the agreement of all parties involved, ensuring that a Syrian exporter can rely on the payment commitment even if market conditions change or the buyer experiences financial difficulties. This irrevocability is particularly important for Syrian businesses that may be perceived as higher risk by international partners due to the country's recent economic challenges.

For Syrian businesses operating in the current environment, letters of credit also provide a mechanism for demonstrating compliance with international regulations and sanctions requirements. Banks involved in letter of credit transactions conduct thorough due diligence on all parties and ensure that transactions comply with applicable laws and regulations. This compliance verification helps Syrian businesses build credibility with international partners and demonstrates their commitment to operating within established legal frameworks.

The cost structure of letters of credit, while representing an additional expense, often provides excellent value for Syrian businesses when compared to the risks of other payment methods. Letter of credit fees typically range from 0.1% to 2% of the transaction value, depending on the complexity of the transaction and the perceived risk of the parties involved. For a Syrian exporter shipping $100,000 worth of olive oil, this might represent a cost of $1,000 to $2,000, which is often justified by the security and payment assurance provided by the letter of credit mechanism.

The educational aspect of letters of credit is particularly important for Syrian businesses that may be encountering these instruments for the first time or returning to their use after years of limited international trade. Understanding the terminology, procedures, and requirements associated with letters of credit enables Syrian companies to negotiate better terms, avoid costly mistakes, and build stronger relationships with international banks and trading partners. This knowledge becomes a competitive advantage in markets where buyers prefer to work with suppliers who demonstrate sophistication in international trade practices.

As Syrian businesses embrace letters of credit as a fundamental tool for international trade, they join a global community of traders who rely on these instruments for secure, efficient, and reliable international commerce. The mastery of letter of credit principles and practices will be essential for Syrian companies seeking to maximize the opportunities created by the country's reintegration into the global economy and establish themselves as reliable, professional partners in international markets.

3. Types of Letters of Credit and Their Applications

The diversity of letter of credit types available to Syrian businesses reflects the varied needs and risk profiles of different international trade scenarios. Understanding these different types and their specific applications enables Syrian exporters and importers to select the most appropriate instrument for their particular circumstances, optimize costs, and maximize security in their international transactions.

Irrevocable Letters of Credit

Irrevocable letters of credit represent the gold standard for Syrian businesses seeking maximum security in international transactions. Once issued, these letters of credit cannot be modified or cancelled without the explicit consent of all parties involved, providing Syrian exporters with ironclad assurance of payment. For a Syrian olive oil producer shipping to European markets, an irrevocable letter of credit ensures that payment will be made regardless of market fluctuations, buyer financial difficulties, or changes in political conditions.

The irrevocable nature of these instruments is particularly valuable for Syrian businesses that may be perceived as operating in a higher-risk environment due to the country's recent economic challenges. When a Syrian spice exporter negotiates with a new customer in the United States, the irrevocable letter of credit demonstrates the buyer's serious commitment to the transaction and provides the Syrian exporter with confidence to invest in production, packaging, and shipping without fear of payment default.

Syrian importers also benefit significantly from irrevocable letters of credit when establishing relationships with new suppliers. A Syrian machinery importer seeking to purchase equipment from Germany can use an irrevocable letter of credit to demonstrate their creditworthiness and commitment to payment, often resulting in better pricing and terms from the German supplier who is assured of payment upon proper shipment of the equipment.

Confirmed Letters of Credit

Confirmed letters of credit add an additional layer of security that is particularly valuable for Syrian businesses working with banks or buyers in countries where political or economic stability may be a concern. In a confirmed letter of credit, a second bank, typically in the beneficiary's country, adds its own payment guarantee to that of the issuing bank. For Syrian exporters, this means that even if the buyer's bank encounters difficulties, the confirming bank will still honor the payment obligation.

The Commercial Bank of Syria, now authorized to participate in international transactions, can serve as a confirming bank for letters of credit issued by foreign banks to Syrian exporters. This arrangement provides Syrian exporters with the comfort of dealing with a local bank while maintaining the security of international payment guarantees. When a Syrian cotton exporter receives a letter of credit from a buyer in Bangladesh, having the Commercial Bank of Syria confirm the letter of credit ensures that payment will be available locally in Syria upon presentation of compliant documents.

Confirmed letters of credit are particularly valuable for Syrian businesses entering new markets where they may be unfamiliar with the reputation and stability of foreign banks. A Syrian processed food exporter expanding into African markets might insist on confirmed letters of credit to ensure payment security, with confirmation provided by a reputable international bank with which they have an established relationship.

The cost of confirmation typically ranges from 0.1% to 0.5% of the letter of credit value, representing a modest investment for the additional security provided. For Syrian businesses building international relationships and establishing credibility in new markets, this additional cost is often justified by the enhanced security and local banking support that confirmation provides.

Standby Letters of Credit

Standby letters of credit function differently from commercial letters of credit, serving as a backup payment mechanism rather than the primary payment method. These instruments are particularly useful for Syrian businesses participating in international tenders, providing performance guarantees, or securing advance payments. Unlike commercial letters of credit that are expected to be drawn upon in normal course of business, standby letters of credit are only utilized if the beneficiary fails to perform their obligations.

For Syrian construction companies bidding on international projects, standby letters of credit can serve as bid bonds, guaranteeing that the Syrian company will enter into the contract if awarded the project. Similarly, Syrian exporters who receive advance payments from international buyers might be required to provide standby letters of credit as advance payment guarantees, ensuring that the advance will be returned if the goods are not delivered as agreed.

The versatility of standby letters of credit makes them valuable tools for Syrian businesses in various scenarios. A Syrian agricultural equipment manufacturer participating in a tender for supplying machinery to a Middle Eastern country might use a standby letter of credit as a performance guarantee, assuring the buyer that the equipment will be delivered and installed according to specifications. If the Syrian company performs as required, the standby letter of credit expires unused; if they fail to perform, the buyer can draw on the standby letter of credit for compensation.

Transferable Letters of Credit

Transferable letters of credit provide Syrian businesses with flexibility in managing complex supply chains and trading relationships. These instruments allow the beneficiary to transfer all or part of the letter of credit to one or more secondary beneficiaries, enabling Syrian trading companies to work with multiple suppliers or subcontractors. This feature is particularly valuable for Syrian businesses that serve as intermediaries in international trade or that need to source components from multiple suppliers to fulfill large orders.

A Syrian agricultural trading company that receives a large order for mixed spices from a European buyer might use a transferable letter of credit to secure supplies from various Syrian spice producers. The trading company can transfer portions of the original letter of credit to individual spice producers, ensuring that each supplier is paid directly by the bank upon delivery of their specific products. This arrangement reduces the trading company's financial risk while providing security to the individual producers.

Transferable letters of credit also enable Syrian businesses to participate in larger international projects that might otherwise be beyond their individual capacity. A Syrian textile manufacturer receiving an order for garments might transfer part of the letter of credit to Syrian cotton suppliers and part to Syrian thread manufacturers, creating a coordinated supply chain that benefits multiple Syrian businesses while fulfilling the international order.

Revolving Letters of Credit

Revolving letters of credit are designed for ongoing business relationships where Syrian businesses engage in regular, repeated transactions with the same international partners. These instruments automatically renew for a specified period, typically one year, allowing multiple shipments to be made under the same letter of credit. This feature is particularly valuable for Syrian exporters who have established regular supply relationships with international buyers.

A Syrian olive oil producer that supplies a European distributor on a monthly basis can benefit from a revolving letter of credit that covers twelve months of shipments. Instead of establishing a new letter of credit for each shipment, the revolving structure allows the Syrian exporter to make monthly shipments, with the letter of credit amount being restored after each compliant presentation of documents. This arrangement reduces administrative costs and processing time while maintaining payment security for both parties.

Revolving letters of credit also provide Syrian importers with efficient mechanisms for managing regular purchases of essential goods. A Syrian pharmaceutical importer that needs to purchase raw materials on a quarterly basis can establish a revolving letter of credit with their supplier, ensuring consistent access to materials while maintaining the security and documentation requirements that protect both parties.

Red Clause Letters of Credit

Red clause letters of credit include special provisions that allow Syrian exporters to receive partial advance payments before shipping goods, providing crucial working capital for production and preparation These instruments are particularly valuable for Syrian businesses that need upfront financing to purchase raw materials, complete production, or prepare goods for export.

For Syrian agricultural exporters who need to purchase and process crops during harvest season, red clause letters of credit can provide the necessary financing to secure raw materials and complete processing before shipment. A Syrian dried fruit exporter might receive a 30% advance payment through a red clause letter of credit, enabling them to purchase fresh fruits, complete the drying and packaging process, and then ship the finished products to receive the remaining 70% of the payment.

The red clause feature is particularly beneficial for Syrian businesses working with seasonal products or those requiring significant upfront investment in raw materials or processing. Syrian textile manufacturers producing custom garments for international buyers can use red clause advances to purchase fabrics and materials, complete production, and then ship the finished garments to receive final payment.

Back-to-Back Letters of Credit

Back-to-back letters of credit enable Syrian trading companies to use their position as beneficiaries of one letter of credit to secure a second letter of credit for their suppliers. This arrangement is particularly useful for Syrian businesses that serve as intermediaries in international trade, allowing them to provide security to their suppliers while maintaining their own payment security from international buyers.

A Syrian trading company that receives a letter of credit from an international buyer for agricultural products can use that letter of credit as collateral to obtain a back-to-back letter of credit for Syrian farmers and producers. This arrangement enables the trading company to provide payment security to local suppliers while ensuring their own payment from the international buyer, creating a secure transaction chain that benefits all parties.

Back-to-back letters of credit are also valuable for Syrian businesses that add value to imported components before re-exporting finished products. A Syrian electronics assembly company that imports components and exports finished products can use back-to-back letters of credit to secure payment for their suppliers while maintaining security for their own export sales.

The selection of the appropriate letter of credit type depends on various factors including the nature of the goods, the relationship between the parties, the risk profile of the transaction, and the specific needs of the Syrian business. Understanding these different types and their applications enables Syrian companies to make informed decisions that optimize security, cost, and operational efficiency in their international trade activities. As Syrian businesses continue to expand their international presence, mastery of these various letter of credit types will be essential for success in global markets.

4. Letters of Credit for Syrian Exporters

Syrian exporters operating in the post-sanctions environment face unique opportunities and challenges that make letters of credit particularly valuable for securing international sales and building sustainable export businesses. The country's diverse export portfolio, ranging from agricultural products to processed foods and raw materials, requires tailored approaches to letter of credit utilization that address specific market requirements and buyer expectations.

Agricultural Exports and Seasonal Considerations

Syria's agricultural exports, led by olive oil, spice seeds, cotton, and tomatoes, present specific challenges that letters of credit can effectively address. The seasonal nature of agricultural production means that Syrian exporters often need to secure sales commitments well in advance of harvest, making letters of credit essential for providing buyers with confidence in delivery while giving exporters assurance of payment.

For Syrian olive oil producers, letters of credit provide crucial advantages in competing with established Mediterranean suppliers. European buyers, who represent a significant market opportunity following sanctions relief, often prefer suppliers who can offer secure payment terms through established banking channels. A Syrian olive oil cooperative exporting to Germany can use letters of credit to demonstrate professionalism and reliability, often resulting in better pricing and longer-term supply agreements.

The quality certification requirements for agricultural exports make letters of credit particularly valuable for Syrian producers. European and North American markets require extensive documentation proving organic certification, quality standards, and food safety compliance. Letters of credit ensure that Syrian exporters will be paid only when they present proper documentation, creating incentives for maintaining high quality standards while protecting buyers from receiving substandard products.

Syrian spice exporters, who benefit from the country's reputation for high-quality herbs and spices, can use letters of credit to expand into premium markets where buyers are willing to pay higher prices for guaranteed quality and reliable delivery. The documentary requirements of letters of credit align perfectly with the certification and quality documentation that premium spice buyers require, creating a natural fit between the payment mechanism and market requirements.

Building Trust with New International Buyers

The sanctions period created a gap in international relationships that Syrian exporters must now rebuild. Letters of credit serve as powerful trust-building tools that enable Syrian companies to establish credibility with new international buyers who may be unfamiliar with Syrian suppliers or concerned about payment and delivery risks.

When a Syrian processed food manufacturer approaches a new distributor in the Gulf countries, offering to work with letters of credit demonstrates the Syrian company's understanding of international trade practices and commitment to professional business relationships. The security provided by letters of credit often enables Syrian exporters to secure initial orders that might otherwise be difficult to obtain, creating opportunities to demonstrate product quality and reliability that can lead to long-term business relationships.

The irrevocable nature of letters of credit is particularly important for Syrian exporters working with buyers who may be concerned about political or economic stability. By accepting irrevocable letters of credit, Syrian exporters provide buyers with assurance that goods will be delivered as agreed, while the buyers provide Syrian exporters with guaranteed payment upon proper shipment and documentation.

Managing Production and Working Capital

Letters of credit provide Syrian exporters with valuable tools for managing production cycles and working capital requirements. The certainty of payment provided by letters of credit enables Syrian companies to invest confidently in production, raw materials, and processing equipment, knowing that payment is assured upon delivery.

Red clause letters of credit are particularly valuable for Syrian exporters who need advance financing for production. A Syrian textile manufacturer producing custom garments for international buyers can use red clause advances to purchase fabrics and materials, pay workers, and complete production before shipment. This financing capability is especially important for Syrian businesses that may have limited access to traditional working capital financing due to the country's recent economic challenges.

The documentary nature of letters of credit also helps Syrian exporters manage quality control and production standards. Knowing that payment depends on presenting compliant documents creates strong incentives for maintaining proper production records, quality certifications, and shipping documentation. This discipline often results in improved operational efficiency and quality management that benefits the Syrian exporter beyond the immediate transaction.

Pricing and Competitive Advantages

Syrian exporters who master the use of letters of credit often find that they can command premium pricing compared to competitors who offer less secure payment terms. International buyers are frequently willing to pay higher prices for suppliers who can offer the security and professionalism associated with letter of credit transactions.

The cost of letters of credit, typically ranging from 0.1% to 2% of the transaction value, is often more than offset by the premium pricing that Syrian exporters can achieve when offering secure payment terms. A Syrian cotton exporter who charges an additional 3% premium for letter of credit terms while paying 1% in letter of credit fees achieves a net benefit of 2% while providing superior security to the buyer.

Letters of credit also enable Syrian exporters to compete more effectively with established suppliers from other countries. When a Syrian olive oil producer competes with Spanish or Italian suppliers for a contract with a US distributor, offering letter of credit terms can differentiate the Syrian supplier and demonstrate their commitment to professional business practices.

Documentation and Compliance Excellence

The documentary requirements of letters of credit create opportunities for Syrian exporters to demonstrate compliance excellence and build reputations for reliability and professionalism. The detailed documentation required for letter of credit transactions often exceeds the minimum requirements for international trade, creating comprehensive records that benefit Syrian exporters in multiple ways.

Syrian agricultural exporters who maintain detailed records for letter of credit compliance often find that these records facilitate compliance with other international requirements such as organic certification, fair trade certification, and quality management systems. The discipline required for letter of credit documentation creates operational improvements that benefit the entire business.

The compliance verification provided by banks in letter of credit transactions also helps Syrian exporters demonstrate their commitment to operating within international legal and regulatory frameworks. This verification is particularly valuable for Syrian businesses seeking to build credibility with international partners and regulatory authorities.

Market Expansion and Growth Strategies

Letters of credit enable Syrian exporters to pursue aggressive market expansion strategies by providing the security and professionalism that new markets often require. The ability to offer letter of credit terms opens doors to markets and customers that might otherwise be inaccessible to Syrian suppliers.

Syrian exporters expanding into new geographic markets can use letters of credit to overcome initial buyer reluctance and establish footholds in competitive markets. The security provided by letters of credit often enables Syrian companies to secure initial orders in new markets, creating opportunities to demonstrate product quality and service reliability that can lead to long-term business relationships.

The transferable letter of credit mechanism enables Syrian trading companies to aggregate smaller producers and create larger, more attractive offerings for international buyers. A Syrian agricultural trading company can use transferable letters of credit to coordinate multiple small farmers and producers, creating consolidated shipments that meet the volume requirements of large international buyers while providing security to all participants.

Risk Management and Insurance

Letters of credit provide Syrian exporters with sophisticated risk management tools that complement traditional export credit insurance and other risk mitigation strategies. The payment security provided by letters of credit reduces the need for expensive credit insurance while providing superior protection against buyer default.

The independence principle of letters of credit protects Syrian exporters from disputes related to the underlying sales contract, ensuring that payment obligations remain intact even if buyers raise quality or delivery concerns. This protection is particularly valuable for Syrian exporters who may be working with new buyers and need assurance that payment disputes will not delay or prevent payment.

Confirmed letters of credit provide additional risk protection for Syrian exporters working with buyers in countries where banking or political stability may be a concern. The confirmation by a reputable international bank ensures that payment will be available even if the buyer's bank encounters difficulties.

Syrian exporters who effectively utilize letters of credit position themselves for sustainable growth in international markets. The security, professionalism, and risk management benefits provided by letters of credit enable Syrian companies to build strong international relationships, command premium pricing, and expand into new markets with confidence. As Syria's reintegration into the global economy continues, exporters who master letter of credit strategies will be best positioned to capitalize on emerging opportunities and achieve long-term success in international trade.

5. Letters of Credit for Syrian Importers

Syrian importers face a transformed landscape following the lifting of international sanctions, with renewed access to global suppliers and financing mechanisms that were previously unavailable. Letters of credit provide Syrian importers with powerful tools for securing essential goods, negotiating favorable terms with international suppliers, and managing the risks associated with international procurement.

Essential Imports and Supply Chain Security

Syria's import requirements, totaling $4.19 billion in 2023, encompass critical goods ranging from refined petroleum and wheat flours to machinery and consumer products. The ability to offer letters of credit to international suppliers significantly enhances Syrian importers' negotiating position and access to reliable supply sources.

For Syrian importers of essential commodities such as wheat and petroleum products, letters of credit provide suppliers with the payment security necessary to establish reliable supply relationships. International grain suppliers, who may have been hesitant to work with Syrian importers during the sanctions period, are now more willing to establish supply agreements when payment is secured through letters of credit issued by authorized Syrian banks.

The Commercial Bank of Syria's renewed ability to issue letters of credit enables Syrian importers to work directly with international suppliers without requiring complex third-party arrangements or advance payments that strain working capital. A Syrian flour mill importing wheat from Ukraine can now issue a letter of credit through the Commercial Bank of Syria, providing the Ukrainian supplier with payment assurance while ensuring that the Syrian importer receives the specified quality and quantity of wheat.

Letters of credit also provide Syrian importers with leverage in negotiating payment terms and pricing with international suppliers. Suppliers who receive secure payment guarantees through letters of credit are often willing to offer better pricing, extended payment terms, or priority delivery schedules. This negotiating advantage is particularly important for Syrian importers who are rebuilding supply relationships and seeking to establish themselves as preferred customers.

Industrial Equipment and Technology Imports

Syrian businesses seeking to modernize their operations and expand production capacity require access to international machinery, equipment, and technology. Letters of credit facilitate these capital investments by providing equipment suppliers with payment security while enabling Syrian importers to verify that equipment meets specifications before payment is released.

The documentary requirements of letters of credit align well with the technical specifications and quality certifications required for industrial equipment imports. A Syrian textile manufacturer importing weaving machinery from Germany can structure the letter of credit to require presentation of technical compliance certificates, installation documentation, and performance test results before payment is released. This arrangement protects the Syrian importer from receiving substandard equipment while providing the German supplier with assurance of payment upon proper delivery and installation.

Usance letters of credit are particularly valuable for Syrian importers of capital equipment, allowing for deferred payment terms that help manage cash flow during equipment installation and commissioning periods. A Syrian food processing company importing packaging machinery can negotiate 90-day payment terms through a usance letter of credit, providing time to install the equipment, complete testing, and begin generating revenue before payment is due.

The transferable letter of credit mechanism enables Syrian importers to coordinate complex projects involving multiple international suppliers. A Syrian construction company importing materials and equipment for a large project can use transferable letters of credit to secure supplies from multiple countries while maintaining centralized payment coordination and documentation control.

Raw Materials and Manufacturing Inputs

Syrian manufacturers across various sectors require reliable access to raw materials and components that are often sourced internationally. Letters of credit provide the payment security and documentation control necessary to establish stable supply chains for these critical inputs.

Syrian pharmaceutical manufacturers, who require high-quality raw materials that meet strict international standards, benefit significantly from the quality assurance mechanisms built into letter of credit transactions. The documentary requirements ensure that raw materials are accompanied by proper certificates of analysis, quality certifications, and compliance documentation before payment is released.

Revolving letters of credit are particularly valuable for Syrian manufacturers who require regular shipments of raw materials or components. A Syrian electronics assembly company that imports components on a monthly basis can establish a revolving letter of credit that covers twelve months of shipments, reducing administrative costs while maintaining payment security for suppliers and quality assurance for the Syrian importer.

The seasonal nature of some Syrian industries makes letters of credit particularly valuable for managing procurement timing and working capital. Syrian food processors who need to import packaging materials and ingredients before peak production seasons can use letters of credit to secure supplies well in advance while managing payment timing to align with production and sales cycles.

Consumer Goods and Retail Imports

Syrian retailers and distributors seeking to offer international brands and products to domestic consumers can use letters of credit to establish relationships with international suppliers and secure access to popular consumer goods. The payment security provided by letters of credit often enables Syrian importers to access brands and products that might otherwise be unavailable due to supplier concerns about payment risk.

The ability to offer irrevocable letters of credit demonstrates to international suppliers that Syrian importers are serious, professional buyers who understand international trade practices. This credibility is particularly important for Syrian retailers seeking to import consumer electronics, fashion items, or other branded products where suppliers carefully select their distribution partners.

Letters of credit also provide Syrian importers with quality control mechanisms that are particularly important for consumer goods where brand reputation and customer satisfaction are critical. The documentary requirements can include quality certificates, brand authorization letters, and compliance documentation that ensure imported goods meet the standards expected by Syrian consumers.

Managing Foreign Exchange and Payment Risks

The foreign exchange challenges that Syrian businesses have faced make letters of credit particularly valuable for managing currency risks and payment timing. Letters of credit denominated in stable international currencies provide Syrian importers with protection against currency fluctuations while ensuring that suppliers receive payment in their preferred currencies.

The Central Bank of Syria's efforts to stabilize the Syrian pound and establish unified exchange rates are supported by the use of letters of credit, which provide transparent, documented foreign exchange transactions that support monetary policy objectives. Syrian importers using letters of credit contribute to the development of a stable, transparent foreign exchange market that benefits the entire economy.

Standby letters of credit can serve as performance guarantees for Syrian importers who need to demonstrate their commitment to international suppliers. A Syrian importer participating in a tender for importing medical equipment might provide a standby letter of credit as a bid guarantee, demonstrating serious intent while protecting the supplier from frivolous bids.

Building Supplier Relationships and Credit History

Letters of credit enable Syrian importers to build positive credit histories and supplier relationships that support long-term business growth. Successful completion of letter of credit transactions creates documented evidence of payment reliability that Syrian importers can use to negotiate better terms and access new suppliers.

The professional documentation and banking involvement in letter of credit transactions help Syrian importers establish credibility with international suppliers who may be unfamiliar with Syrian businesses. This credibility building is particularly important for Syrian companies seeking to establish themselves as reliable, long-term partners in international supply chains.

Syrian importers who consistently use letters of credit and maintain good relationships with their banks often find that they can access larger credit facilities and more favorable terms for future transactions. This credit building capability is essential for Syrian businesses seeking to expand their operations and increase their import volumes.

Compliance and Regulatory Advantages

The compliance verification inherent in letter of credit transactions helps Syrian importers demonstrate adherence to international regulations and standards. Banks involved in letter of credit transactions conduct thorough due diligence that helps ensure compliance with sanctions regulations, export controls, and other international requirements.

The detailed documentation required for letter of credit transactions creates comprehensive records that facilitate customs clearance, regulatory compliance, and audit requirements. Syrian importers who maintain proper letter of credit documentation often find that customs and regulatory processes are more efficient and less problematic.

The banking oversight provided in letter of credit transactions also helps Syrian importers avoid potential compliance issues that could jeopardize their ability to engage in international trade. Banks' expertise in international regulations and sanctions compliance provides valuable protection for Syrian businesses navigating complex regulatory environments.

Syrian importers who effectively utilize letters of credit position themselves to take full advantage of the opportunities created by sanctions relief and Syria's reintegration into the global economy. The payment security, supplier relationship benefits, and compliance advantages provided by letters of credit enable Syrian companies to rebuild and expand their international procurement capabilities while managing risks and building sustainable business relationships. As Syria continues its economic recovery and integration into global markets, importers who master letter of credit strategies will be best positioned to secure reliable supply chains and support the country's economic growth.

6. The LC Process: Step-by-Step Guide for Syrian Businesses

Understanding the letter of credit process is essential for Syrian businesses to effectively utilize this powerful trade finance instrument. The process involves multiple steps, parties, and documentation requirements that must be carefully managed to ensure successful completion of international transactions.

Initial Negotiation and Sales Contract

The letter of credit process begins during the negotiation phase between Syrian businesses and their international trading partners. For Syrian exporters, this involves discussing payment terms with potential buyers and explaining the benefits of letter of credit arrangements. Syrian importers, conversely, need to understand how to propose letter of credit terms to international suppliers and negotiate favorable conditions.

When a Syrian olive oil producer negotiates with a European distributor, the discussion of payment terms should include the specific type of letter of credit, the required documents, the timeline for presentation, and any special conditions. The sales contract should clearly specify that payment will be made through a letter of credit and reference the specific terms that will be included in the letter of credit document.

The negotiation phase is crucial for establishing the foundation of a successful letter of credit transaction. Syrian businesses should ensure that the letter of credit terms align with their operational capabilities and that they can realistically meet all documentary and timing requirements. This includes considering production schedules, shipping arrangements, and the availability of required certificates and documentation.

Application and Issuance Process

Once the sales contract is finalized, the buyer (applicant) submits a letter of credit application to their bank. For Syrian importers, this involves working with Syrian banks such as the Commercial Bank of Syria to establish the letter of credit facility and provide the necessary financial backing or collateral.

The application process requires detailed information about the transaction, including the beneficiary's details, the goods being purchased, the required documents, and the terms and conditions for payment. Syrian importers must provide their bank with comprehensive information about the supplier, the goods being imported, and the commercial terms of the transaction.

The issuing bank reviews the application, assesses the applicant's creditworthiness, and determines whether to issue the letter of credit. For Syrian businesses, this review process may include additional due diligence related to sanctions compliance and regulatory requirements. Banks will verify that all parties to the transaction are authorized for international business and that the transaction complies with applicable laws and regulations.

Once approved, the issuing bank creates the letter of credit document, which contains detailed terms and conditions that the beneficiary must meet to receive payment. This document specifies the exact documents required, the timeline for presentation, the expiry date, and any special conditions or requirements.

Advising and Confirmation

The issuing bank transmits the letter of credit to an advising bank in the beneficiary's country. For Syrian exporters, this is typically a Syrian bank that has correspondent relationships with international banks. The Commercial Bank of Syria, now reconnected to the SWIFT system, can serve as an advising bank for letters of credit issued by foreign banks to Syrian exporters.

The advising bank's role is to authenticate the letter of credit and forward it to the beneficiary. Syrian exporters should carefully review the letter of credit terms upon receipt and immediately notify the advising bank of any discrepancies or concerns. It is much easier to request amendments before beginning production or shipment than after goods have been prepared or shipped.

If additional security is desired, the advising bank can add its confirmation to the letter of credit, creating a confirmed letter of credit. This confirmation means that the Syrian bank guarantees payment even if the issuing bank encounters difficulties. For Syrian exporters working with buyers in countries where banking stability may be a concern, confirmation provides valuable additional security.

Production and Preparation Phase

Upon receiving and accepting the letter of credit terms, Syrian exporters can begin production and preparation of the goods. The letter of credit provides assurance that payment will be made upon proper presentation of documents, enabling Syrian businesses to invest confidently in production, raw materials, and processing.

During this phase, Syrian exporters must carefully manage the production process to ensure that goods meet the specifications outlined in the letter of credit. Any deviations from the specified quality, quantity, or packaging requirements could result in discrepancies that delay or prevent payment.

Syrian businesses should maintain detailed records throughout the production process to support the documentation that will be required for letter of credit presentation. This includes quality control records, production certificates, and any testing or inspection reports that may be required by the letter of credit terms.

Shipping and Documentation

Once goods are ready for shipment, Syrian exporters must arrange transportation and prepare the required documents for letter of credit presentation. The shipping process must comply with the terms specified in the letter of credit, including the shipping timeline, destination, and any special shipping requirements.

The documentation phase is critical for successful letter of credit completion. Syrian exporters must prepare all required documents exactly as specified in the letter of credit, ensuring that all details match precisely. Common documents include commercial invoices, packing lists, bills of lading, insurance certificates, and various quality or origin certificates.

For Syrian agricultural exporters, this often includes phytosanitary certificates, quality certificates, and organic certification documents that are required for entry into international markets. The documentary requirements serve dual purposes: they ensure that Syrian exporters meet international quality standards while providing buyers with assurance that goods meet their specifications.

Document Presentation and Examination

Syrian exporters must present the required documents to the advising or confirming bank within the timeframe specified in the letter of credit, typically 21 days after the shipping date. The bank examines the documents to ensure they comply exactly with the letter of credit terms and conditions.

The examination process is detailed and precise, with banks checking every aspect of the documents for compliance with the letter of credit requirements. Even minor discrepancies, such as spelling errors or inconsistent dates, can result in rejection of the documents and delay of payment.

If discrepancies are found, the bank will notify the Syrian exporter and provide an opportunity to correct the documents or seek a waiver from the buyer. Syrian businesses should work closely with their banks to understand common discrepancy issues and implement quality control procedures to minimize documentation errors.

Payment and Settlement

Upon acceptance of compliant documents, the bank processes payment according to the letter of credit terms. For sight letters of credit, payment is made immediately upon acceptance of documents. For usance letters of credit, payment is made on the specified future date.

Syrian exporters receive payment in the currency specified in the letter of credit, typically a major international currency such as US dollars or euros. The payment is made through the banking system, providing secure and traceable transfer of funds that supports both parties' record-keeping and compliance requirements.

The completion of payment marks the successful conclusion of the letter of credit transaction. Syrian exporters should maintain comprehensive records of the entire process for future reference, compliance purposes, and relationship building with banks and trading partners.

Post-Transaction Activities

Following successful completion of a letter of credit transaction, Syrian businesses should conduct post-transaction analysis to identify lessons learned and opportunities for improvement. This includes reviewing the efficiency of the documentation process, the accuracy of timeline estimates, and the effectiveness of communication with banks and trading partners.

Successful letter of credit transactions create valuable precedents that Syrian businesses can reference in future negotiations with the same or different trading partners. Banks also maintain records of successful transactions that support credit assessments for future letter of credit applications.

Syrian businesses should use successful letter of credit experiences to build stronger relationships with their banks and explore opportunities for expanded credit facilities or more favorable terms for future transactions. The track record of successful letter of credit completion demonstrates creditworthiness and operational competence that banks value in their commercial relationships.

Common Challenges and Solutions

Syrian businesses may encounter various challenges during the letter of credit process, particularly as they rebuild international trade relationships and adapt to new regulatory environments. Common challenges include documentation discrepancies, timing issues, and communication difficulties with international banks and trading partners.

To minimize these challenges, Syrian businesses should invest in training and education for staff involved in letter of credit transactions. Understanding the precise requirements and common pitfalls helps ensure smooth transaction processing and builds confidence among international trading partners.

Working closely with experienced Syrian banks and seeking guidance from trade finance professionals can help Syrian businesses navigate complex letter of credit requirements and avoid costly mistakes. The AlTojjar platform provides valuable resources and connections that support Syrian businesses in mastering letter of credit processes and building successful international trade relationships.

The letter of credit process, while complex, provides Syrian businesses with a structured, secure framework for international trade that supports business growth and relationship building. Mastery of this process is essential for Syrian companies seeking to maximize the opportunities created by the country's reintegration into the global economy and establish themselves as reliable, professional partners in international markets.

7. Banking Infrastructure and Institutional Support

The transformation of Syria's banking infrastructure following sanctions relief has created unprecedented opportunities for Syrian businesses to access international trade finance services. Understanding the current banking landscape and available institutional support is crucial for Syrian companies seeking to effectively utilize letters of credit and other trade finance instruments.

Syrian Banking System Reconstruction

The Commercial Bank of Syria, as the country's primary state-owned commercial bank, has emerged as a central player in facilitating international trade finance for Syrian businesses. The bank's inclusion in the US General License 25 and its reconnection to the SWIFT international messaging system have restored its ability to participate fully in international letter of credit transactions.1.

The bank's renewed capabilities include issuing letters of credit for Syrian importers, advising and confirming letters of credit for Syrian exporters, and maintaining correspondent relationships with international banks. This restoration of basic banking services provides Syrian businesses with local access to international trade finance expertise and eliminates the need for complex third-party arrangements that were necessary during the sanctions period.

The Central Bank of Syria's efforts to stabilize the currency and establish unified exchange rates support the effective use of letters of credit by providing more predictable foreign exchange conditions. The central bank's coordination with international monetary authorities and its commitment to transparency in foreign exchange transactions create a more stable environment for international trade finance.

Private banking institutions in Syria, including the International Bank for Trade and Finance (IBTF), are expanding their trade finance capabilities to serve the growing demand from Syrian businesses. These private banks often provide more specialized services and competitive pricing, creating healthy competition that benefits Syrian importers and exporters seeking trade finance solutions.

International Correspondent Banking Relationships

The restoration of correspondent banking relationships between Syrian banks and international financial institutions is fundamental to the effective operation of letter of credit services. These relationships enable Syrian banks to authenticate, advise, and confirm letters of credit issued by foreign banks while providing international banks with confidence in Syrian banking partners.1.

Major international banks with Middle Eastern operations, including Emirates NBD, Qatar National Bank, and Arab Bank, have begun reestablishing correspondent relationships with Syrian banks. These relationships provide Syrian businesses with access to a broader network of international banking services and enhance the credibility of Syrian banks in international markets.

European banks, particularly those with experience in emerging markets, are also exploring correspondent relationships with Syrian banks as part of the broader normalization of commercial relationships. These relationships are particularly important for Syrian exporters targeting European markets, as they provide local banking support and expertise in European regulatory requirements.

The SWIFT reconnection has been crucial for reestablishing these correspondent relationships, as it provides the secure messaging infrastructure necessary for international banking communications. Syrian banks can now communicate directly with international partners, reducing transaction times and improving the efficiency of letter of credit processing.

Regional Financial Integration

Syria's reintegration into regional financial networks provides Syrian businesses with access to specialized trade finance institutions and programs designed to support Middle Eastern and Arab trade. The Arab Trade Financing Program (ATFP) and similar regional initiatives offer financing solutions specifically designed for Arab businesses engaged in international trade.

Regional development banks, including the Islamic Development Bank and the Arab Monetary Fund, are exploring opportunities to support Syrian trade finance through various programs and initiatives. These institutions often provide more favorable terms and specialized expertise in regional trade patterns and requirements.

The Gulf Cooperation Council (GCC) countries, which represent significant markets for Syrian exports, have well-developed banking systems that can support trade finance relationships with Syrian businesses. Syrian exporters targeting GCC markets can benefit from the sophisticated trade finance infrastructure available in these countries.

Turkey's continued trade relationship with Syria provides another avenue for banking and trade finance support. Turkish banks with experience in Syrian markets can serve as intermediaries and facilitators for Syrian businesses seeking to access broader international markets.

Trade Finance Capacity Building

Syrian banks are investing in training and capacity building to restore their trade finance expertise and meet the growing demand from Syrian businesses. This includes training staff in international trade finance practices, letter of credit procedures, and compliance requirements.

International banking organizations and trade finance associations are providing technical assistance and training programs to support the development of Syrian banking capabilities. These programs help ensure that Syrian banks can provide professional, reliable services that meet international standards.

The Central Bank of Syria is working with international partners to develop regulatory frameworks and supervisory capabilities that support safe and sound trade finance operations. This regulatory development is essential for building confidence among international banking partners and ensuring the long-term sustainability of Syrian trade finance services.

Professional associations and industry groups are emerging to support the development of trade finance expertise among Syrian businesses and banking professionals. These organizations provide networking opportunities, educational resources, and advocacy for policies that support international trade.

Technology and Digital Infrastructure

The modernization of Syrian banking technology infrastructure is essential for efficient letter of credit processing and international trade finance operations. Syrian banks are investing in digital platforms and systems that enable electronic document processing, automated compliance checking, and real-time transaction monitoring.

The adoption of international standards for electronic trade finance, including the International Chamber of Commerce's digital trade finance initiatives, helps Syrian banks integrate with global trade finance networks. This technological integration reduces processing times, improves accuracy, and enhances the overall efficiency of letter of credit transactions.

Blockchain and distributed ledger technologies are being explored by Syrian banks as potential solutions for improving trade finance transparency, reducing fraud, and streamlining documentation processes. While still in early stages, these technologies offer promising opportunities for enhancing Syrian trade finance capabilities.

Digital platforms that connect Syrian businesses with international trading partners and financial institutions are emerging as important tools for market access and relationship building. The AlTojjar platform exemplifies this trend by providing Syrian businesses with digital access to global markets and trade finance resources.

Risk Management and Compliance Infrastructure

Syrian banks are developing sophisticated risk management capabilities to support safe and sound trade finance operations while ensuring compliance with international regulations and standards. This includes implementing know-your-customer (KYC) procedures, anti-money laundering (AML) controls, and sanctions compliance monitoring.

The development of credit assessment capabilities enables Syrian banks to evaluate the creditworthiness of local businesses seeking trade finance facilities while providing international partners with confidence in Syrian banking risk management practices. These capabilities are essential for supporting the growth of trade finance volumes and maintaining banking relationships.

Insurance and guarantee mechanisms are being developed to support trade finance operations and provide additional security for international transactions. Export credit insurance, bank guarantees, and other risk mitigation tools help Syrian businesses access trade finance while managing the risks associated with international trade.

Regulatory compliance systems ensure that Syrian banks and businesses operate within the framework of international laws and regulations, including sanctions requirements, export controls, and anti-terrorism financing measures. These systems are essential for maintaining access to international markets and banking relationships.

Future Development and Opportunities

The continued development of Syrian banking infrastructure presents significant opportunities for expanding trade finance capabilities and supporting economic growth. Planned investments in technology, training, and international partnerships will enhance the ability of Syrian banks to serve their business customers and compete in regional markets.

The potential for Islamic banking and finance services in Syria offers opportunities to access specialized financing mechanisms that align with regional preferences and religious requirements. Islamic trade finance instruments, including murabaha and ijara structures, could provide alternative financing options for Syrian businesses.

The development of specialized trade finance institutions, including export-import banks and trade finance companies, could provide additional sources of financing and expertise for Syrian businesses. These institutions could focus specifically on supporting Syrian international trade and developing specialized expertise in key export sectors.

Regional integration initiatives, including potential membership in regional trade finance organizations and development banks, could provide Syrian businesses with access to broader financing networks and specialized programs designed to support regional trade development.

The banking infrastructure and institutional support available to Syrian businesses represents a fundamental transformation from the constraints of the sanctions period. Syrian companies that effectively leverage these resources and build strong banking relationships will be best positioned to capitalize on the opportunities created by the country's reintegration into the global economy. The continued development of this infrastructure will be essential for supporting sustainable growth in Syrian international trade and establishing the country as a reliable partner in regional and global markets.

8. Compliance and Documentation Requirements

The successful utilization of letters of credit by Syrian businesses requires meticulous attention to compliance and documentation requirements that have become increasingly sophisticated in the post-sanctions environment. Understanding these requirements is essential for ensuring smooth transaction processing and maintaining access to international markets.

International Regulatory Framework

Syrian businesses operating in the current environment must navigate a complex web of international regulations that govern trade finance transactions. The lifting of sanctions has restored access to international markets, but it has also introduced new compliance obligations that Syrian companies must understand and implement.

The US General License 25 and similar European and UK measures provide broad authorization for trade finance transactions involving Syrian businesses, but they maintain specific restrictions and reporting requirements. Syrian companies must ensure that their transactions do not involve prohibited parties, including individuals and entities that remain on sanctions lists, and that they do not benefit countries that remain subject to comprehensive sanctions.

The Financial Action Task Force (FATF) standards for anti-money laundering and counter-terrorism financing apply to all international trade finance transactions involving Syrian businesses. Banks participating in letter of credit transactions must conduct enhanced due diligence on Syrian parties and ensure that transactions comply with international standards for preventing financial crimes.

Export control regulations from various countries continue to apply to certain goods and technologies that Syrian businesses may seek to import. Understanding these restrictions is crucial for Syrian importers who must ensure that their letter of credit applications comply with applicable export control requirements and that suppliers are authorized to export the requested goods to Syria.

Know Your Customer (KYC) and Due Diligence

The enhanced due diligence requirements for Syrian businesses reflect the international banking community's commitment to ensuring compliance with applicable laws and regulations. Syrian companies seeking to utilize letters of credit must be prepared to provide comprehensive information about their business operations, ownership structures, and commercial activities.

Syrian exporters must provide detailed information about their production facilities, quality control procedures, and export capabilities to banks and international trading partners. This information helps establish credibility and demonstrates the Syrian company's ability to fulfill international orders according to specified requirements.

The beneficial ownership requirements mandate that Syrian businesses disclose the ultimate ownership and control structures of their companies. This transparency is essential for banks conducting due diligence and for ensuring compliance with sanctions and anti-money laundering requirements.

Financial statements, business licenses, and operational documentation must be current and properly authenticated to meet international banking standards. Syrian businesses should work with qualified accountants and legal advisors to ensure that their documentation meets international requirements and accurately reflects their business operations.

Documentary Requirements for Letters of Credit

The documentary requirements for letters of credit involving Syrian businesses often exceed standard international requirements due to enhanced compliance obligations and the need to demonstrate adherence to quality and safety standards. Understanding these requirements is crucial for successful transaction completion.

Commercial documents must be prepared with exceptional attention to detail, ensuring that all information is accurate, consistent, and compliant with letter of credit terms. Syrian exporters should implement quality control procedures for document preparation to minimize discrepancies that could delay payment or require costly amendments.

Transport documents for Syrian exports must comply with international shipping regulations and may require additional certifications or endorsements. Syrian businesses should work closely with freight forwarders and shipping companies that understand the specific requirements for shipments from Syria to various international destinations.

Insurance documents must provide adequate coverage and comply with international standards for cargo insurance. Syrian exporters should work with reputable insurance providers that can issue internationally recognized insurance certificates and provide coverage that meets the requirements of international buyers and banks.

Quality and Safety Certifications

Syrian exporters, particularly those in the agricultural and food sectors, must obtain various quality and safety certifications that are required for entry into international markets. These certifications serve dual purposes: they ensure compliance with importing country requirements while providing buyers with assurance of product quality.

Phytosanitary certificates are required for most Syrian agricultural exports and must be issued by authorized Syrian government agencies. These certificates attest that exported products are free from pests and diseases and comply with the plant health requirements of importing countries.

Organic certification is increasingly important for Syrian agricultural exporters targeting premium markets in Europe and North America. Syrian producers must work with internationally recognized certification bodies to obtain organic certification that is accepted in target markets.

Food safety certifications, including HACCP (Hazard Analysis and Critical Control Points) and ISO 22000 standards, are often required for Syrian food exporters. These certifications demonstrate that Syrian producers maintain international standards for food safety and quality management.

Quality management system certifications, such as ISO 9001, help Syrian businesses demonstrate their commitment to quality and continuous improvement. These certifications are particularly valuable for Syrian manufacturers seeking to establish long-term relationships with international buyers.

Sanctions Compliance and Monitoring

Ongoing sanctions compliance remains a critical requirement for Syrian businesses utilizing letters of credit, even after the lifting of broad sanctions against Syria. Syrian companies must implement compliance programs that ensure their transactions do not violate remaining restrictions or involve prohibited parties.

Sanctions screening procedures must be implemented to check all transaction parties against current sanctions lists. Syrian businesses should utilize professional sanctions screening software or services to ensure comprehensive coverage of all relevant sanctions lists and regular updates as lists are modified.

Transaction monitoring systems help Syrian businesses identify potentially problematic transactions before they are executed. These systems can flag transactions involving high-risk countries, suspicious amounts, or unusual patterns that may require additional review.

Documentation and record-keeping requirements mandate that Syrian businesses maintain comprehensive records of all international transactions for specified periods. These records must be readily available for review by banks, auditors, and regulatory authorities.

Banking Compliance Requirements

Syrian banks participating in letter of credit transactions must meet enhanced compliance standards that reflect international best practices for trade finance operations. These requirements help ensure the integrity of the international financial system while supporting legitimate trade activities.

Customer identification procedures require Syrian banks to verify the identity of all parties to letter of credit transactions and maintain current information about their business activities and risk profiles. This information must be regularly updated and reviewed to ensure continued accuracy.

Transaction reporting requirements may mandate that Syrian banks report certain types of transactions to regulatory authorities. Understanding these requirements helps Syrian businesses anticipate potential delays or additional documentation requirements.

Correspondent banking compliance ensures that Syrian banks maintain relationships with international partners that meet global standards for banking operations and compliance. These relationships are essential for the effective operation of letter of credit services.

Technology and Automation in Compliance

The adoption of technology solutions for compliance management helps Syrian businesses and banks meet complex regulatory requirements while maintaining operational efficiency. These solutions can automate many compliance processes and reduce the risk of human error.

Automated document checking systems can verify that letter of credit documents comply with specified requirements and identify potential discrepancies before documents are presented to banks. These systems help reduce processing times and improve accuracy.

Electronic sanctions screening tools provide real-time checking of transaction parties against current sanctions lists and can be integrated with banking systems to provide automatic screening of all transactions.

Digital audit trails created by modern banking systems provide comprehensive records of all transaction activities and compliance checks, supporting regulatory reporting requirements and internal risk management procedures.

Training and Capacity Building

The complexity of compliance requirements makes training and capacity building essential for Syrian businesses and banking professionals involved in letter of credit transactions. Ongoing education helps ensure that all parties understand current requirements and best practices.

Professional certification programs for trade finance professionals help ensure that Syrian banking staff have the knowledge and skills necessary to support complex letter of credit transactions while maintaining compliance with international standards.

Industry associations and professional organizations provide ongoing education and networking opportunities that help Syrian businesses stay current with evolving compliance requirements and best practices.

International training programs and technical assistance initiatives provide Syrian businesses and banks with access to global expertise and best practices in trade finance compliance and risk management.