International trade, a cornerstone of global economic prosperity, hinges on a meticulous dance of goods, finances, and, crucially, documentation. For Syrian exporters looking to tap into the lucrative European market, understanding and mastering this documentation is not merely a bureaucratic hurdle but a strategic imperative. Accurate and complete paperwork ensures smooth customs clearance, prevents costly delays, and builds trust with international partners. Syria, with its rich history of trade and diverse products, possesses immense export potential. By streamlining the documentation process, Syrian businesses can unlock new opportunities and contribute significantly to the nation's economic revitalization. This article will delve into the essential trade documents required for exporting to Europe, highlight how digital platforms like AlTojjar can simplify this process, and provide actionable insights to avoid common pitfalls, ultimately paving the way for seamless and successful trade ventures.

Key Documents: Invoices, Packing Lists, and Certificates of Origin

Successful export to Europe hinges on the precise preparation of several core documents. These aren't just formalities; they are legal instruments that facilitate the movement of goods, ensure proper payment, and verify compliance with international trade regulations. For Syrian exporters, a thorough understanding of these documents—the commercial invoice, packing list, and certificate of origin—is paramount.

Commercial Invoice: The Financial Blueprint of Your Shipment

The commercial invoice serves as the fundamental record of the transaction between the exporter and the importer. It is the document that formally charges the importer for the goods supplied and is universally required for customs clearance in the European Union [1]. While no specific form is mandated by the EU, the commercial invoice must contain comprehensive details to ensure transparency and facilitate accurate assessment by customs authorities. Key information to include on a commercial invoice typically encompasses:

- Information on the Exporter and the Importer: Full legal names, addresses, and contact details of both parties involved in the transaction.

- Date of Issue: The date the invoice is generated.

- Invoice Number: A unique identifier for the transaction, crucial for tracking and record-keeping.

- Description of the Goods: A clear, precise, and detailed description of the products, including their name, quality, and any relevant specifications. This should align with the Harmonized System (HS) codes for accurate classification.

- Unit of Measure: The standard unit used to quantify the goods (e.g., kilograms, liters, pieces).

- Quantity of Goods: The total number of units for each item.

- Unit Value: The price per unit of the goods.

- Total Item Value: The total value for each specific type of good (quantity multiplied by unit value).

- Total Invoice Value and Currency of Payment: The grand total of all goods, clearly stating the currency of payment. For EU imports, the equivalent amount should be indicated in a currency freely convertible to Euro or other legal tender in the importing Member State.

- Payment terms: Details regarding the payment method, due dates, and any agreed-upon discounts.

- Terms of Delivery (Incoterms): The agreed-upon Incoterms (International Commercial Terms) that define the responsibilities of the buyer and seller for the delivery of goods, including costs and risks. This is critical for determining who is responsible for various stages of the shipping process.

- Means of Transport: The mode of transportation used for the shipment (e.g., sea freight, air freight, road transport).

It is standard practice for the exporter to prepare the commercial invoice. While an original and at least one copy are typically required, and often signed by both parties, the EU does not strictly require a signature. Although the invoice can be prepared in any language, a translation into English is highly recommended to avoid any misunderstandings or delays during customs processing [1].

Packing List: A Detailed Inventory for Logistics and Customs

The packing list is a crucial document that provides a comprehensive inventory of the contents of a shipment. Unlike the commercial invoice, which focuses on financial aspects, the packing list details the physical characteristics of the goods, making it indispensable for logistics, warehousing, and customs inspection. It aids customs officials in verifying the contents of the shipment against the commercial invoice and helps prevent discrepancies that could lead to delays [2]. Key information typically found on a packing list includes:

- Number of Pieces: The total count of packages or cartons in the shipment.

- Weight: Both gross and net weight of each package and the total shipment.

- Dimensions: The measurements (length, width, height) of each package.

- Itemized Breakdown of Contents: A detailed list of each item within each package, including quantities and descriptions. This level of detail is vital for customs inspections and for the importer to verify receipt of goods.

Similar to the commercial invoice, the EU does not prescribe a specific format for the packing list; it should be prepared by the exporter according to standard business practices [2]. An accurate and detailed packing list is essential for efficient cargo handling, load planning, and for resolving any discrepancies that may arise during transit or upon arrival at the destination port.

Certificate of Origin: Verifying the Goods' Pedigree

The certificate of origin (COO) is an international trade document that attests to the country where the goods were manufactured or produced. This document is critical for customs clearance in the EU and must be declared and presented alongside the Single Administrative Document (SAD) [1]. The COO plays a significant role in determining tariffs, quotas, and eligibility for preferential trade agreements.

There are generally two types of certificates of origin:

- Certificates of Non-Preferential Origin: These certificates confirm the country of origin but do not qualify the goods for any preferential tariff treatment. They are typically issued by chambers of commerce in the exporting country.

- Certificates of Preferential Origin: These are more significant for exporters as they allow goods to benefit from reduced or zero customs duties when imported from countries with which the EU has signed preferential trade agreements. These certificates must be issued by the customs authorities of the exporting country.

For Syrian exporters, understanding preferential origin rules is particularly important, as it can significantly impact the competitiveness of their products in the European market. The type of preferential certificate required depends on the specific trade agreement. Common examples include:

- Form A: Used for goods qualifying under the Generalized System of Preferences (GSP) regime.

- EUR MED or EUR 1: Used for specific cases within the Pan-Euro-Mediterranean (PEM) system or other preferential agreements.

- Invoice Declarations: For consignments up to €6,000, any exporter in the beneficiary country can issue an invoice declaration. For consignments exceeding €6,000, only an approved exporter can issue these declarations. The REX system (Registered Exporter System) is a particular case of invoice declarations, allowing registered exporters to self-certify the origin of goods [1].

Accurate and properly issued certificates of origin are vital for Syrian goods to receive the correct tariff treatment and avoid unnecessary duties, thereby enhancing their price competitiveness in the European market. The process of obtaining these certificates requires close coordination with relevant authorities and a thorough understanding of the rules of origin specific to each product and destination.

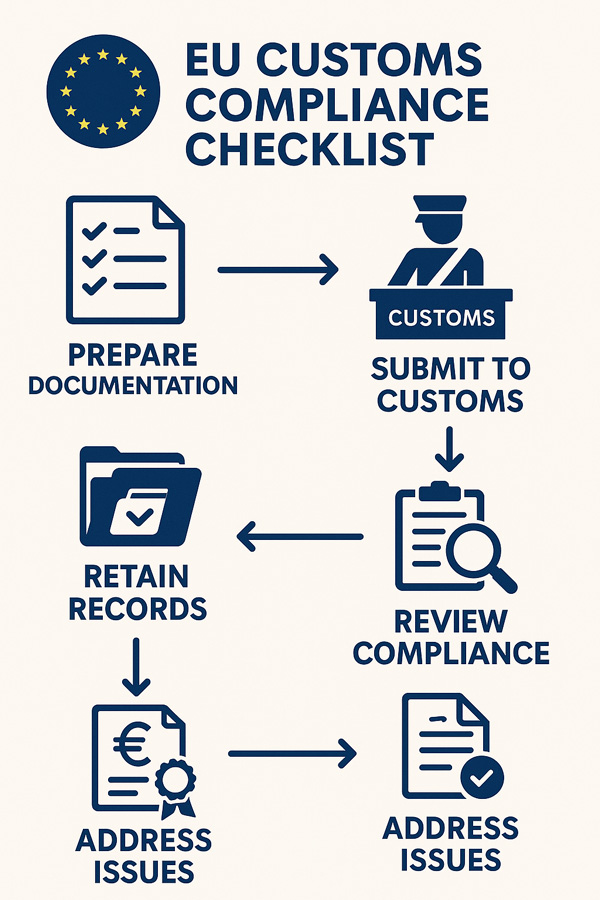

Navigating European Customs: Specific Documentation Requirements for EU Markets

Beyond the core documents, navigating the intricacies of European customs requires an understanding of additional specific requirements. The European Union operates under a harmonized system, but certain documents and procedures are crucial for seamless entry into its vast market. Syrian exporters must be aware of these to ensure compliance and avoid any delays at the border.

The Single Administrative Document (SAD)

The Single Administrative Document (SAD) is the official model for written declarations to customs in the EU. It serves as the importer's declaration and describes the goods and their movement. The SAD is a multi-purpose form used for various customs procedures, including import, export, and transit. While much of the information required for the SAD is derived from the commercial invoice and packing list, it is the overarching document that consolidates all necessary data for customs authorities [1].

Customs Value Declaration (DV 1 Form)

For imported goods with a value exceeding EUR 20,000, a Customs Value Declaration (DV 1 form) must be presented to the customs authorities. The primary purpose of this declaration is to assess the transaction value accurately, which then determines the customs value (taxable value) for applying tariff duties. This form ensures that all costs incurred, including the commercial price, transport, and insurance up to the first point of entry in the EU, are considered for duty calculation. The DV 1 form must be drawn up conforming to form DV 1, whose specimen is laid down in Annex 8 to Regulation (EU) 2016/341 [1].

Other Potential Documents and Considerations

Depending on the nature of the goods, the mode of transport, and specific EU regulations, Syrian exporters may encounter requirements for additional documents:

- Transport Documents: These include documents like the Bill of Lading (B/L) for sea freight, Air Waybill (AWB) for air cargo, or Road Waybill (CMR) for road transport. These documents serve as proof of receipt of goods by the carrier, evidence the contract of carriage, and convey title to the goods [CITF Book, Topic 5].

- Import Licenses or Permits: Certain goods, such as those related to health, safety, or environmental protection, may require specific import licenses or permits from relevant EU authorities. It is crucial for exporters to research these requirements well in advance.

- Inspection Certificates: For products like food, agricultural goods, or certain industrial products, inspection certificates may be necessary to verify compliance with EU health, safety, and quality standards.

- Special Certificates: Depending on the product, other specialized certificates might be required, such as phytosanitary certificates for plants, veterinary certificates for animal products, or certificates of conformity for certain manufactured goods.

The Economic Operator Registration and Identification (EORI) Number

All economic operators (businesses or individuals) involved in customs activities within the EU must have an Economic Operator Registration and Identification (EORI) number. This unique identification number is used by customs authorities across the EU for all customs-related activities. Syrian exporters are not directly required to have an EORI number, but their EU importers will need one to clear goods through customs. Understanding this requirement helps Syrian exporters guide their partners and ensure all necessary prerequisites are met on the EU side.

Digital Documentation: How AlTojjar Simplifies Document Management

The traditional landscape of international trade documentation has long been characterized by paper-intensive processes, manual handling, and the inherent risks of errors, delays, and loss. For Syrian exporters, navigating these complexities can be particularly challenging, especially when dealing with the stringent requirements of European customs. This is where digital platforms like AlTojjar emerge as transformative solutions, simplifying document management and enhancing the efficiency of the entire export process.

AlTojjar is designed to bridge critical gaps in trade infrastructure, offering a suite of digital trade facilitation tools that directly address documentation challenges. Its core value proposition includes digital documentation management and compliance verification tools. These features are specifically tailored to help Syrian exporters prepare accurate and complete documents, thereby mitigating the risks of delays and ensuring smooth customs clearance in European markets.

The AlTojjar Advantage in Document Management:

- Streamlined Creation and Storage: AlTojjar provides a centralized digital hub where exporters can create, store, and manage all their trade documents—from commercial invoices and packing lists to certificates of origin and transport documents. This eliminates the need for physical paperwork, reducing administrative burden and the risk of misplacement or damage.

- Enhanced Accuracy and Consistency: The platform can incorporate smart templates and validation checks, guiding exporters to fill in all necessary fields correctly and consistently. This significantly reduces common errors such as incomplete information or inconsistencies across different documents, which are frequent causes of customs delays.

- Real-time Collaboration: Digital platforms enable seamless collaboration between exporters, freight forwarders, and other stakeholders. Documents can be shared instantly, reviewed, and approved, accelerating the entire documentation workflow.

- Compliance Verification: AlTojjar’s compliance verification tools are invaluable for Syrian exporters. These tools can help cross-reference documentation against the latest EU import regulations, ensuring that all required information is present and correctly formatted. This proactive approach helps identify potential compliance issues before the shipment even leaves Syria, preventing costly rejections or penalties at the destination.

- Reduced Processing Times: By digitizing the documentation process, AlTojjar significantly cuts down on the time traditionally spent on preparing, sending, and verifying paper documents. This efficiency translates into faster customs clearance and quicker delivery of goods to European markets.

- Accessibility and Security: Digital documents are accessible from anywhere with an internet connection, providing flexibility for exporters. Furthermore, reputable platforms like AlTojjar employ robust security measures to protect sensitive trade data, ensuring confidentiality and integrity.

By leveraging AlTojjar’s digital documentation capabilities, Syrian exporters can transform a historically cumbersome process into a streamlined, efficient, and error-resistant operation. This not only saves time and resources but also builds confidence and reliability in their international trade dealings, fostering stronger relationships with European importers.

Avoiding Delays: Common Documentation Errors and How to Prevent Them

Even with a solid understanding of required documents, errors can creep into the process, leading to frustrating and costly delays at customs. For Syrian exporters, every delay means lost time, potential financial penalties, and a dent in their reputation. Recognizing common documentation pitfalls and implementing preventative measures is crucial for ensuring a smooth and efficient export journey to Europe.

Common Documentation Errors:

- Incomplete Information: This is perhaps the most frequent error. Missing details on invoices, such as Incoterms, payment terms, or a full description of goods, can halt a shipment. For example, a commercial invoice lacking the precise unit of measure or the total invoice value in a convertible currency will likely be flagged by EU customs [1].

- Inconsistencies Across Documents: Discrepancies between the commercial invoice, packing list, and bill of lading are red flags for customs authorities. If the quantity of goods on the invoice doesn't match the packing list, or if the consignee's address differs between documents, it can trigger extensive checks and delays.

- Incorrect Classification: Misclassifying goods with the wrong Harmonized System (HS) codes can lead to incorrect duties, fines, or even re-exportation. This often happens due to a lack of understanding of product-specific classification rules.

- Missing Documents: Forgetting to include a required certificate of origin, an import license for restricted goods, or a specific inspection certificate can bring a shipment to a standstill. For instance, if a product requires a phytosanitary certificate and it's not present, the goods will not be cleared.

- Typographical Errors: Simple typos in names, addresses, quantities, or values can cause significant problems, as customs systems are often automated and sensitive to exact matches.

- Outdated Information: Relying on old templates or regulations can lead to non-compliance. Trade regulations, especially in the EU, are subject to change, and using outdated forms or procedures can result in rejections.

Practical Tips for Prevention:

Preventing these errors requires a systematic and diligent approach. Syrian exporters can adopt the following actionable tips to minimize risks:

- Double-Check All Details Meticulously: Before submitting any document, review every field for accuracy, completeness, and consistency across all related paperwork. A second pair of eyes, if possible, can catch errors that the original preparer might overlook.

- Utilize Standardized Templates and Checklists: Develop and use standardized templates for commercial invoices, packing lists, and other recurring documents. Create detailed checklists for each shipment to ensure all required documents are prepared and included.

- Understand Product-Specific Requirements: Research and confirm any specific licenses, permits, or certificates required for your particular goods in the target EU market. This includes understanding relevant HS codes and any specific quality or safety standards.

- Seek Expert Advice: Don't hesitate to consult with trade finance experts, customs brokers, or freight forwarders who specialize in EU imports. Their knowledge can be invaluable in navigating complex regulations and preventing errors.

- Leverage Digital Tools: As highlighted, platforms like AlTojjar offer digital documentation management and compliance verification tools. These systems can automate data entry, cross-reference information, and flag potential errors, significantly reducing manual mistakes.

- Maintain Clear Communication: Foster open and clear communication with your European importer, freight forwarder, and any other parties involved in the logistics chain. Confirm all details and requirements before shipment.

- Keep Records Organized: Maintain a well-organized digital and physical archive of all trade documents for future reference, audits, and dispute resolution.

By proactively addressing these common pitfalls, Syrian exporters can significantly reduce the likelihood of delays, ensuring their goods reach European markets efficiently and without unnecessary complications. This attention to detail not only streamlines operations but also builds a reputation for reliability and professionalism in the international trade arena.

Ensuring Compliance: Meeting Quality Standards Through Accurate Paperwork

Compliance in international trade extends beyond merely having the right documents; it encompasses adhering to a myriad of regulations, standards, and legal frameworks that govern the movement of goods across borders. For Syrian exporters targeting the European Union, accurate paperwork is not just an administrative task but a fundamental pillar of compliance, directly impacting the quality and legality of their exports. The EU has some of the most stringent import regulations globally, designed to protect consumers, the environment, and fair trade practices. Meeting these standards through meticulous documentation is non-negotiable.

The Indispensable Link Between Documentation and Compliance

Every piece of documentation, from the commercial invoice to the certificate of origin, serves as a verifiable record of compliance. For instance:

- Commercial invoice: Accurately reflects the value and description of goods, which is crucial for correct tariff application and preventing undervaluation or misdeclaration, both of which are serious compliance breaches.

- Packing List: Provides a transparent view of the physical contents, enabling customs to verify that the goods match their declarations and are not subject to any import prohibitions or restrictions.

- Certificate of Origin: Verifies the origin of goods, which is critical for applying preferential tariffs, enforcing trade policy measures (like anti-dumping duties), and ensuring that goods from sanctioned entities are not inadvertently imported.

- Health and Safety Certificates: For products such as food, pharmaceuticals, or certain industrial goods, specific health, safety, or quality certificates are mandatory. Accurate documentation proves that these goods have undergone the necessary inspections and meet the rigorous EU standards.

Any inaccuracy or omission in these documents can lead to significant compliance issues, including fines, seizure of goods, re-exportation, or even blacklisting of the exporter. For Syrian businesses, maintaining a reputation for compliance is vital for building long-term trade relationships and fostering trust in the international market.

AlTojjar's Role in Compliance Verification

AlTojjar recognizes the critical importance of compliance for Syrian exporters. Its platform offers compliance verification tools designed to assist businesses in navigating the complex regulatory landscape of international trade. These tools can:

- Provide Up-to-Date Regulatory Information: Access to current information on EU import regulations, quality standards, and any specific requirements for various product categories. This helps exporters stay informed about changes in legislation that could impact their shipments.

- Automated Checks and Alerts: The platform can perform automated checks on submitted documentation against known compliance requirements, flagging potential issues before they become costly problems. This proactive approach allows exporters to correct errors or gather missing information in advance.

- Guidance on Product-Specific Standards: For Syrian agricultural products, textiles, or other goods, AlTojjar can offer guidance on specific EU quality standards, labeling requirements, and certifications needed for market entry.

By leveraging AlTojjar's compliance features, Syrian exporters can significantly reduce their risk of non-compliance. This not only ensures smoother customs clearance but also demonstrates a commitment to international best practices, enhancing the credibility and marketability of Syrian products in Europe. Staying updated on regulatory changes and proactively verifying compliance through digital tools is an investment in the long-term success and sustainability of Syrian export ventures.

Conclusion

For Syrian exporters, the path to seamless trade with Europe is paved with meticulous preparation and an unwavering commitment to accurate documentation. The commercial invoice, packing list, and certificate of origin form the bedrock of this process, each playing a vital role in ensuring transparency, facilitating logistics, and verifying compliance. Navigating the specific requirements of European customs, including the Single Administrative Document and various transport documents, further underscores the need for precision and attention to detail.

Syria possesses a rich heritage and immense potential in international trade. By embracing modern solutions and adhering to global best practices in documentation, Syrian businesses can overcome historical challenges and confidently access the vast opportunities presented by the European market. The journey towards successful export is a testament to resilience, strategic planning, and the adoption of tools that empower growth.

Unlock Your Export Potential with AlTojjar

Are you a Syrian exporter looking to expand your reach into European markets? Do you need expert guidance on navigating complex trade finance regulations or streamlining your documentation process? AlTojjar is your dedicated partner in international trade.

Contact AlTojjar today for personalized trade finance guidance. Our team of experts can provide tailored advice to help you understand specific market requirements, optimize your financial strategies, and ensure compliance every step of the way.

Beyond expert consultation, AlTojjar offers a comprehensive suite of services designed to facilitate your export journey:

- B2B Matching: Connect with verified European importers and expand your network through our intelligent business matching services.

- Trade Facilitation: Leverage our digital platform for efficient document management, compliance verification, and streamlined logistics coordination.

- Educational Resources: Access our extensive knowledge base and AlTojjar Academy for up-to-date information on trade regulations, market insights, and best practices.

Let AlTojjar be your digital bridge to global markets, transforming challenges into opportunities and helping your business thrive in the international arena. Visit AlTojjar.com or contact us directly to learn more about how we can support your export ambitions.

References

[1] European Commission. (2025, June 1). Customs clearance documents and procedures | Access2Markets. https://trade.ec.europa.eu/access-to-markets/en/content/customs-clearance-documents-and-procedures

[2] European Commission. (n.d.). Packing list | Access2Markets. https://trade.ec.europa.eu/access-to-markets/en/glossary/packing-list

[CITF Book, Topic 5] Certificate in International Trade Finance (CITF) book, Topic 5: Trade Documents.